No matter how many staff a company has, every business needs someone to pay the wages. Whether that’s done in-house, or outsourced to a specialist provider, getting staff paid correctly and on-time is fundamental for a company’s success.

A career in payroll can offer a good salary and stable career prospects because of the responsibility that comes with the job. Payrollers are responsible not just for ensuring a happy workforce, but also for making sure companies are compliant with other regulations, such as getting National Insurance and pension contributions set up correctly.

However it’s a competitive field to get into so it’s hard to stand out from the crowd on a CV. So if you’re looking for your next career move in payroll, read on and see what companies are most keen to spot on a CV when recruiting for payroll jobs in Stockport.

1. Size of the payroll

The first question we are always asked by clients about payroll candidates is “How many people do they payroll for?” Because a job in payroll requires you to meet lots of deadlines, the more people’s pay you process each period can be indicative of the workload you are used to handling.

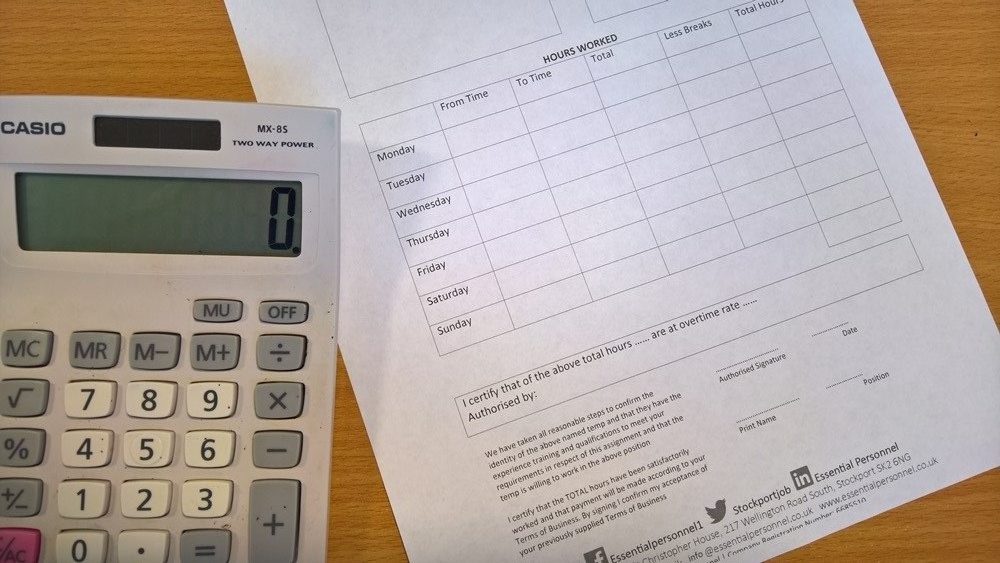

Bigger numbers aren’t always better though – some payrolls are more complex than others. Do you deal with sick pay and maternity, lots of overtime or flexible contracts where people are paid different amounts each month and on different rates? Equally, are you doing weekly, fortnightly or month payroll runs, or a mix of all three? For roles within payroll bureaus and accountancy practices, where you’ll be handling more complex payroll runs for a portfolio of clients, these other factors will come into the mix.

2. Industry or Practice?

The next question clients ask is typically whether someone has worked within an industry setting, or for an outsourced role. As mentioned previously, candidates working in payroll bureaus typically deal with more complex payroll runs, whereas in-house payroll is typically more straightforward. However, the main reason industry candidates are often looked over by accountancy practices is because they aren’t always handling the process from end-to-end.

Payroll is a process, with multiple steps from uploading timesheets onto a system to making the payments to employees and to HMRC, and in many companies, parts of that process will go to different people. For example, line managers or an HR Administrator may do the data entry element of inputting timesheets, while someone else does the deductions calculations before someone more senior in the accounts department authorises the payments. In an accountancy practice or bureau setting however, one person will do the process end to end for a set of clients, so that if anything goes wrong there is a single point of contact for them to liaise with.

3. Attention to detail

The most important thing for a payroller to demonstrate to be in contention however is attention to detail. After all, I’m sure most of us know from past experience how frustrating and stressful it can be when we spot mistakes on our payslips! If those mistakes are regularly repeated, bureaus will lose clients, companies will lose staff and both will lose money. Make sure you double check your CV for typos and spelling mistakes (ask a friend to read over it too, as fresh eyes are usually more likely to spot mistakes that you don’t!) because these will really stick out to payroll and finance managers, who really are sticklers for detail.

A lot of CV writing advice recommends talking up your achievements – the projects you’ve completed, the sales you’ve made – but a successful payroll assistant is someone who consistently gets the job done and gets the job done right. This can be hard to get across on a CV, but if you can hit these three points on your CV, you’ll just have to prove your worth in an interview.

Payroll jobs, while not for everyone, can offer great career prospects if you’re good with numbers, have a good eye for detail, and work well to deadlines. For a confidential discussion about your next career move in accounts or payroll, get in touch with out specialist recruitment consultant Jacqui Francis-Lamont.